It’s nearly impossible to get a clear picture of how many people are currently active on X (formerly Twitter). If you ask the company, 550 million people use it every month, up 1.5% since last summer. If you ask third parties like Edison Research or Sensor Tower, usage is down 30% year over year and the user base has been flat or down every month since Elon Musk acquired the app in November 2022.

Considering the turmoil and conflicting data points, it’s easy to understand why many clients at Spectrum Science have asked whether they should continue to use the once-essential platform.

The answer is deceptively simple: Companies should keep using the platform (any platform) if their audiences are active there.

And since Spectrum is fully staffed with data-centric experts, we set out to determine if the audiences our clients are most interested in are still using X.

Using Medical Conferences as a Proxy

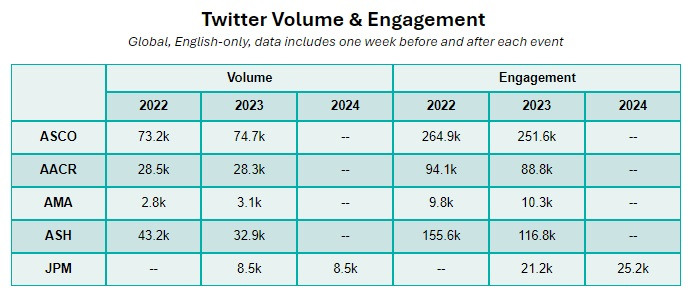

To get started, we needed to find a way to identify X activity from members of our target audiences. For the most part, our clients are interested in reaching healthcare professionals (a big bucket that can include academics, researchers, scientists, doctors, nurses and other care providers), and we know that medical meetings and conferences act as a social media lightning rod across many of these subgroups. We decided to compare the volume of and engagement with X posts during several major conferences year after year to see if the audiences were still there.

The results were mixed. Volume ticked up at the American Society of Clinical Oncology (ASCO) Annual Meeting between 2022-2023, but engagement dropped. Both metrics increased at the American Medical Association (AMA) Annual Meeting, but both decreased at the American Society of Hematology (ASH) Annual Meeting and Exposition. When we looked at the J.P. Morgan (JPM) Health Care Conference in 2023 vs. 2024, volume was flat, but engagement grew. In aggregate, the volume of X posts across these conferences dipped 2.36% and engagement was down by a similar 2.32%.

Based on these figures, our recommendation to clients with an established presence on X is to maintain their foothold on the platform. For some, that means going largely dormant except during major medical conferences. Others are publishing organic content several times a week and seeing steady engagement. Some are comfortable adding paid campaigns to extend their reach beyond their current followers, others are shifting paid spend to other channels.

At least for the moment, scientists and healthcare professionals remain reachable on X. But what if that changes?

If Not On X, Then Where?

While we’re comfortable with the data and recommendation for our clients to continue using X in the short term, we’re also planning for the possibility that our target audiences will not always be engaged there. But with the wide range of would-be replacements for X, it’s challenging to pick a platform. Some have been short-lived, like Pebble (Nov. 2022-Oct. 2023), and others like Bluesky, Threads and Mastodon seem to have more staying power.

A team of researchers at Arizona State University analyzed 14,270 users who migrated from X to other platforms in July and August 2023 (immediately after Threads launched) to determine if they left X, where they went and if they stayed on the other platforms. Their research will be presented at the SIAM International Conference on Data Mining this week.

Although there was a spike in deleted accounts immediately after it was rebranded from Twitter to X, the researchers found that many users tested the new platforms but ultimately returned to X or decided to use both X and a new offering. The exception is Mastodon, where more users were active there, exclusively, than on X throughout the data collection period.

Determining if your audience is part of the group that made the move to Mastodon can be a tall order. The platform is decentralized by design, which means individuals you want to reach are likely scattered across multiple servers. Users can interact across those instances, but it can make finding the people you want to reach a bit more complicated (particularly without an advertising option).

If you have a hunch your audience might be on Mastodon, start by looking for the individuals who tend to lead the conversation. Finding them could give you a foothold and help you locate and follow others in the niche. Then, based on the size and influence of the network you uncover, you can determine if it’s worth your time to devote resources to a presence there.

At Spectrum, we’re most concerned with healthcare and science-focused audiences (you can learn more about our work here). Have you seen evidence that groups—within those niches or otherwise—have established a new home on another platform? We’d love to hear about it!

Perspectives

Media

Digital Dose: Disablement of Third-Party Cookie Tracking and X’s 2024 Development Plan

Media

Digital Dose: ByteDance New AI Model and Navigating a Cookieless World

Media

Digital Dose: LinkedIn’s New Media Planning API and a New Trending Topics Feature on Threads

Media

Digital Dose: Google and Reddit’s Latest Partnership and Tips for Engaging Gen Z on LinkedIn